Why AI Voice Detection Matters for Financial Institutions

Fighting Fraud with AI Voice Detection

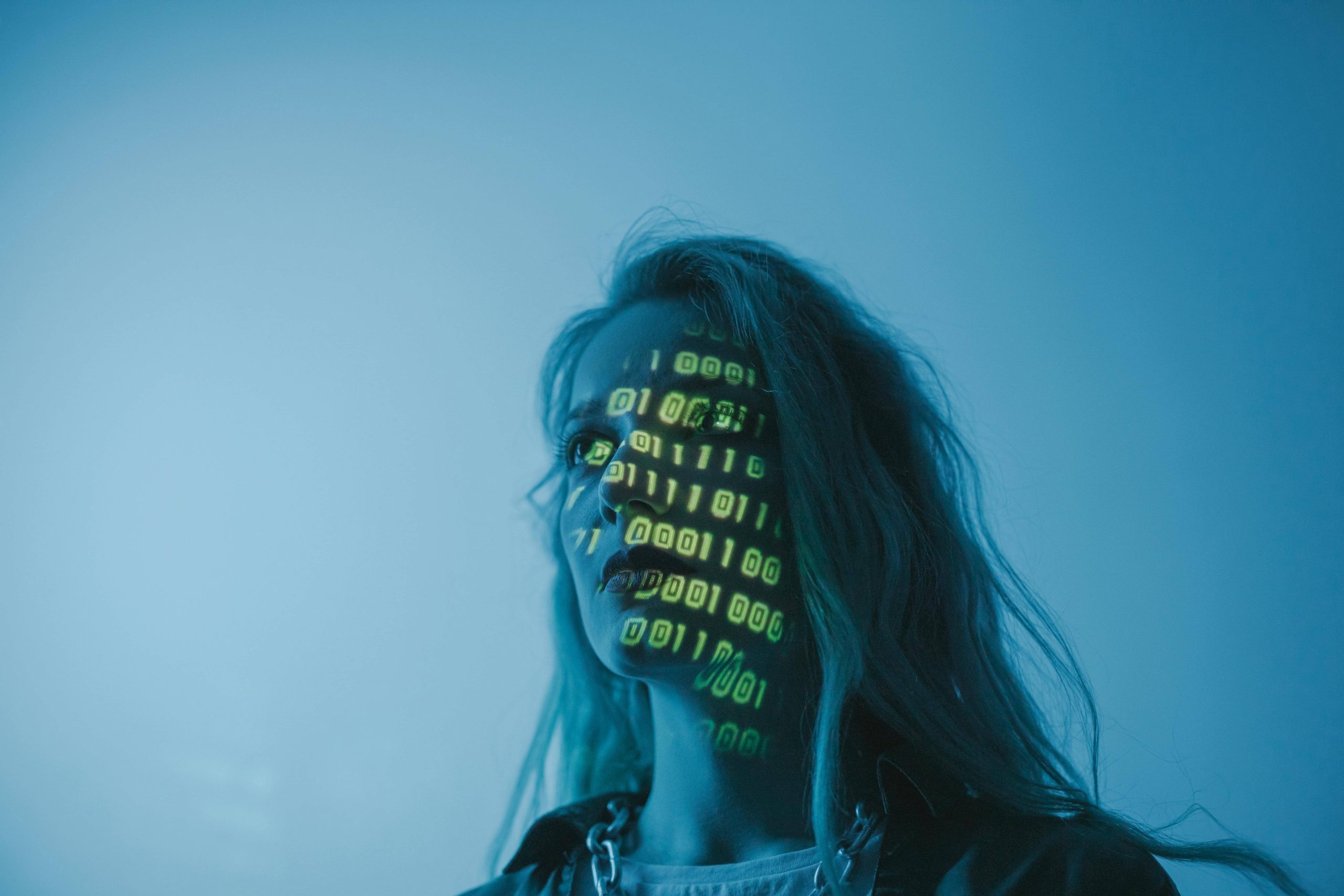

In a world where voice-based banking and customer service are on the rise, impersonation scams are getting more sophisticated. That’s where AI voice detection comes in. This technology helps banks and financial institutions verify if the voice on the other end is really who it claims to be—or if it’s an AI-generated clone trying to commit fraud.

As deepfake audio becomes more convincing, AI voice detection adds a critical layer of security. It can flag synthetic speech and alert institutions before money is moved or accounts are compromised.

Impersonation is No Longer a Joke

Scammers can now replicate someone’s voice with just a short clip. From fake calls to fraudulent account access, voice cloning is becoming a real problem in the financial world. That’s why institutions are investing in tools that analyze vocal patterns and acoustic markers to catch fakes in real-time.

Voice detection systems trained on real and synthetic data can recognize unnatural inflections, odd pauses, or patterns too perfect to be human—traits often present in AI-generated speech.

Secure Transactions, Safer Customers

Whether it’s a voice-activated payment system or a call center authentication, AI voice detection can make the difference between a secure transaction and a costly mistake. Banks are increasingly combining voice detection with other biometrics (like facial or behavioral recognition) to lock down security at every touchpoint.

For institutions, it’s not just about protecting the money—it’s about protecting customer trust.

Detection is the First Line of Defense

Platforms like aimusicdetection.com are expanding to support AI voice detection tools that help flag cloned or synthetic audio. For financial institutions dealing with millions of calls and transactions daily, this kind of detection helps reduce risk and ensures compliance with evolving security standards.

Voice detection tech is also being integrated into compliance systems to verify recorded calls and maintain audit trails.

Conclusion

As voice tech continues to reshape banking, AI voice detection will be key to keeping fraud in check. Financial institutions need to be proactive, because in a world of voice deepfakes, it’s not just what’s said that matters, but who’s saying it. Detection tools make sure that synthetic voices don’t gain real-world access.